Feature of Operations

Supporting Micro/Small Businesses

As of the end of FY2022, Business Loans were provided to 1.19 million businesses. The average loan balance per business is 9.35 million yen, most of which were small loans.

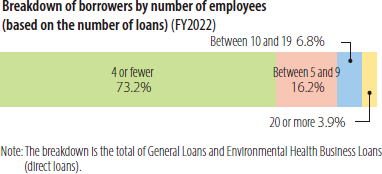

Approximately 90% of borrowers are micro/small businesses with nine or fewer employees, and many are sole proprietors. Over 90% of all loans are uncollateralized.

We made every effort to support micro/small businesses affected by COVID-19, and as a result, the number of the businesses received business loans increased by approximately 320,000 compared to March 31, 2020.

| Micro Business and Individual Unit |

Total for shinkin banks(254 banks) |

Total for domestic banks(132 banks) |

|

|---|---|---|---|

| Number of business borrowers(million) |

1.19 | 1.25 | 2.22 |

| Average loan balance per business(million yen) |

9.35 | 43.18 | 107.75 |

- Notes:

-

- Figures for Micro Unit are the total of General Loans and Environmental Health Business Loans.

- Domestic banks include major commercial banks, regional banks, regional banks II, and trust banks.

- Figures for shinkin banks (based on “total” in Deposits and Loans Market statistics by the Bank ofJapan) and for domestic banks (based on “SMEs” in Deposits and Loans Market statistics by theBank of Japan) do not include loans to individuals (loans for housing, consumption, tax payments,etc.), loans to regional public organizations, overseas yen-loans, or loans made to businesses in foreign countries in name of their domestic branches.

- Number of businesses for shinkin banks and domestic banks are based on the number of loans in Deposits and Loans Market statistics by the Bank of Japan.

Source: Bank of Japan website

Demonstrating Safety Net Functions

Response to the Spread of COVID-19

The Micro Unit created special consultation desks at its 152 branches nationwide and is providing consultations on financing and repayment for micro/small businesses that have been impacted by the COVID-19 pandemic. We are providing COVID-19 Special Loan Program to clients that meet certain conditions such as a decline in sales.

From January 29, 2020, the day when the consultation desks were established, to March 31, 2023, we provided a total of 1,096,872 COVID-19 related loans worth a total of 12,463.4 billion yen.

Measures during disasters

A special consultation desk is immediately established in case of a major earthquake such as the Great East Japan Earthquake, other natural disasters such as typhoons or torrential rains, a major corporate bankruptcy, or other unforeseen events so that affected micro/small businesses can discuss their loan and repayment conditions.

| Number of consultation desks |

Consultation desks currently in operation | Date of establishment |

|

|---|---|---|---|

| Disaster-related | 9 | Special consultation desk for the Great East Japan Earthquake | Mar. 2011 |

| Special consultation desk for damage suffered as a result of heavy rain from July 3, 2020 | Jul. 2020 | ||

| Special consultation desk for damage suffered as a result of heavy rain from August 11, 2021 | Aug. 2021 | ||

| Special consultation desk for damage suffered as a result of the earthquake off the coast of Fukushima prefecture in 2022 | Mar. 2022 | ||

| Special consultation desk for damage suffered as a result of heavy rain from August 3, 2022 | Aug. 2022 | ||

| Special consultation desk for damage suffered as a result of Typhoon No. 14 of 2022 | Sep. 2022 | ||

| Special consultation desk for damage suffered as a result of Typhoon No. 15 of 2022 | Sep. 2022 | ||

| Special consultation desk for damage suffered as a result of the earthquake in Noto Peninsula of Ishikawa Prefecture in 2023. | May. 2023 | ||

| Special consultation desk for damage suffered as a result of the heavy rain brought by the seasonal rain front and Typhoon No. 2 of 2023 | Jun. 2023 | ||

| Others | 3 | Special consultation desk relating to COVID-19 | Feb. 2020 |

| Special consultation desk relating to situation in Ukraine and rising oil prices, etc. | Nov. 2021 | ||

| Special consultation desk for SMEs relating to supply chain of Hino Motors | Apr. 2022 |

Supporting Customers' Business Continuity and Growth

We share information on our customers' managerial strengths and issues through dialogue with them, not only when providing loans, but in all phases including post-financing follow-ups. When addressing these issues that have been shared, we use financial diagnostic services and SWOT analysis services to provide advice and information that is useful for management as well as support collaboratively with outside experts.

Supporting Business Start-ups (consisting of those that have yet to start and those that are within 1 year of start-up) Proactively

Support for business start-ups

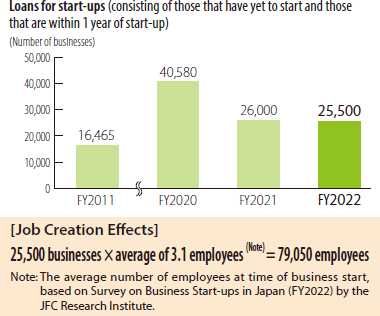

Not a few companies that have yet to start and those that are within 1 year of start-up face difficulties in raising funds for such reasons as a shortage of business experiences. The Micro Unit actively provides loans to these companies to support their business activities.

The Micro Unit provided loans to a total of 25,500 business start-ups(consisting of those that have yet to start and those that are within 1 year of start-up) in FY2022. It is estimated that about 79,000 jobs were created annually as a result.

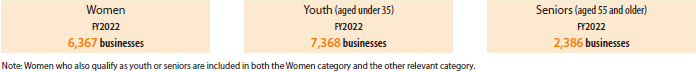

Supporting women, youth, and senior entrepreneurs

As the economic society diversify, the range of business start-ups has been expanding start-ups by women who take advantage of their ability to notice the small things in daily life, young people who utilize novel ideas, and seniors who draw on their many years of experience. In such trend, Micro Unit actively provides loans to such women, youth, and senior entrepreneurs.

Loans for women, youth, and senior entrepreneurs (number of businesses)

Business Start-up Support Desks have been established in the 152 branch offices nationwide

Business Start-up Support Desks provide services in which specialists offer advice on business start-up plans to people planning to start up a business and offer a wide variety of information on starting a business.

Establishment of Business Start-up Support Centers and Business Support Plazas and Providing Support for Business Start-ups

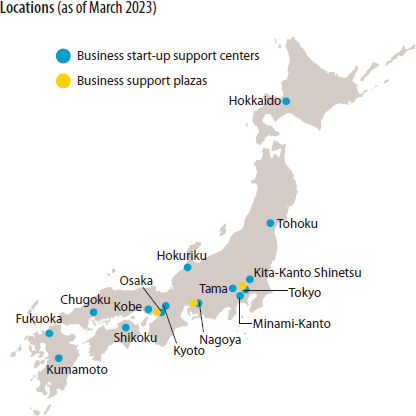

The Micro Unit has established business start-up support centers and business support plazas throughout Japan. Through these facilities, we support a wide range of business start-ups.

- Establishment of business start-up support centers throughout Japan

Centers are located in 15 regions of Japan from Hokkaido to Kyushu. Centers organize diverse seminars targeted at customers in varying stages of their business cycle, both before and after starting business, and also provide timely support to customers through collaboration with regional organizations that support start-ups.

- Establishment of business support plazas throughout Japan

Three locations: Tokyo (Shinjuku), Nagoya, and Osaka. Appointments for in-depth consultation are available to persons who plan to start a new business. For those who cannot consult during regular business hours, weekend appointments are also available (excluding national holidays).

Note: Sunday consultations are available on first and third Sundays of each month at Tokyo (Shinjuku) Business Support Plaza.

Supporting Start-ups

To contribute to the growth and development of start-ups striving to achieve rapid growth that serve as a driving force to innovation and provide original value with innovative ideas, JFC-Micro provides financing that does not rely on guarantors including "Capital Subordinated Loan" as well as core business support such as business matching with large companies.

Supporting Business Revitalization Actively

Business revitalization support staff have been deployed at 152 branches nationwide to respond flexibly to requests for relaxing repayment terms, e.g., a reduction in the installment amount, temporary deferment of principal repayment, etc. In addition, by way of loan programs for business revitalization support and by providing advice for the resolution of business issues and support for the enactment of business improvement plans, the Micro Unit supports businesses undergoing corporate reorganization in cooperation with private financial institutions, outside experts, and public support organizations.

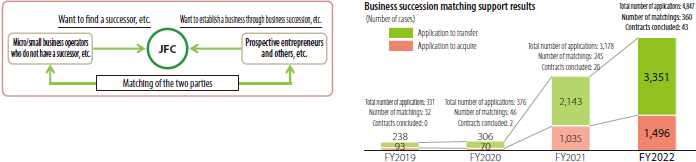

Supporting Business Succession Actively

To support micro/small businesses in securing successors, the Micro Unit conducts a nationwide business succession matching support program to match micro/small businesses that do not have a successor with people who wish to start their own businesses. We also disseminate information on business succession diagnosis and best practices and hold events in collaboration with business succession support centers, Chambers of Commerce and Industry, and Societies of Commerce and Industry to raise the awareness of business owners and facilitate third-party succession. In addition, we support business succession from both the information and capital aspects in cooperation with regional financial institutions to respond to diverse capital needs relating to business succession.

Supporting Social Business Actively

The Micro Unit supports bearers of social businesses that support regional and social issues, such as supporting the care and welfare of the elderly and disabled, child rearing, environmental conservation, and regional revitalization.

The FY2022 loans to social businesses came to: 15,296 loans, 126.5 billion yen.

Supporting Businesses Seeking for Overseas Expansion Actively

Overseas Expansion Support Desks are established at 152 branches nationwide to actively support businesses that are working to expand overseas. JFC-Micro cooperates with Japan External Trade Organization (JETRO), Organization for Small & Medium Enterprises and Regional Innovation, JAPAN (SME Support, JAPAN), Japan Federation of Bar Associations, and other organizations that support overseas expansion. We establish consultations systems that can provide detailed support information according to the needs of customers by providing advice for first-time overseas expansion, information on overseas exhibitions and business matching events, and confirmation of local laws and regulations, required permits and licenses, and the details of contracts.

Collaboration with Regional Financial Institutions, Chambers of Commerce and Industry, Societies of Commerce and Industry, and Environmental Health Trade Associations

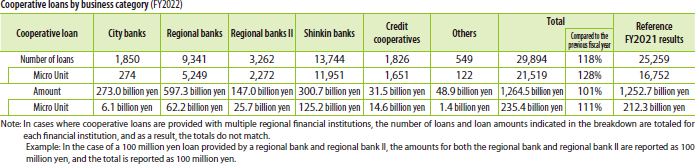

Collaboration with regional financial institutions

We promote cooperation with regional financial institutions to support customers affected by the COVID-19 pandemic and price hikes, etc., revitalize the regional economy, and meet the customer's convenience.

We are actively engaged in providing collaborative loans to help with the development of the cooperative loan scheme (Note) and the creation of cooperative loan products, which is part of efforts to enhance the effectiveness of cooperation with regard to support in various fields including the COVID-19 response, business start-ups, business revitalization.

Note: A cooperative loan scheme has specific referral rules for projects treated as cooperative loans.

Total of cooperative loan(Note)

In FY2022, total cooperative loans from regional financial institutions came to: 21,519 loans, 235.4 billion yen.

Note: Loans (guarantees) that are disbursed or decided by both JFC and regional financial institutions after consultation by both parties for loan plans with identical objectives(Calculated by JFC. Including loans made on different dates between both parties).

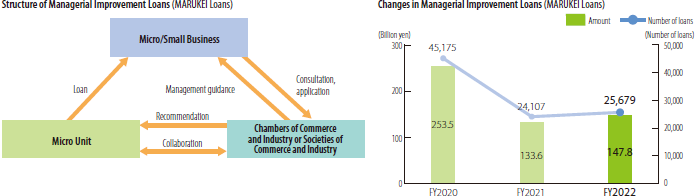

Collaboration with Chambers of Commerce and Industry, and with Societies of Commerce and Industry

Micro Unit works in close collaboration with regional Chambers of Commerce and Industry, and with Societies of Commerce and Industry throughout Japan to support business improvement of micro/small businesses through providing Managerial Improvement Loans (MARUKEI Loans) and consultation sessions.

Managerial Improvement Loans (MARUKEI Loans) are a program whereby micro/small businesses receiving management guidance, such as from Chambers of Commerce and Industry or Societies of Commerce and Industry, can utilize funds needed for managerial improvement without collateral and guarantors. JFC marked 50 years since the establishment of this program in October 1973, and to date, 5.23 million loans have been provided.

Holding of “One-Day JFC” consultation sessions at Chambers of Commerce and Industry or at Societies of Commerce and Industry

Consultation sessions called “One-Day JFC,” where staff from Micro Unit consult on finance, are held at Chambers of Commerce and Industry or at Societies of Commerce and Industry. Every year, many micro/small businesses come to ask for advice. In addition, we also conduct online consultations to enhance customer convenience.

Cooperation with approved management innovation support organizations (Note) such as tax accountants, certified public accountants, and SME management consultants

Management support provided through approved management innovation support organizations such as tax accountant, etc. who play a large role in supporting SMEs and micro/small businesses, and financial support from JFC come together to support micro/small business owners in business sectors like start-ups, management innovation, business revitalization, etc.

Note: Approved management innovation support organizations are support organizations recognized under the Small and Medium-sized Enterprises Business Enhancement Act. Please visit the Small and Medium Enterprise Agency website for more information.

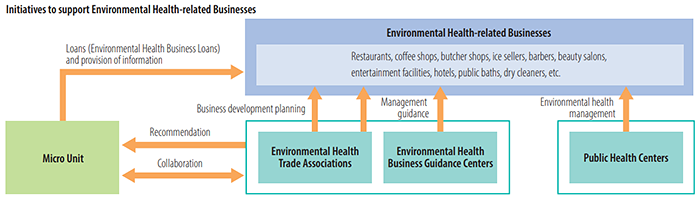

Collaboration with Environmental Health Trade Associations and Environmental Health Business Guidance Centers

The Micro Unit works in close collaboration with such organizations as Environmental Health Trade Associations and Environmental Health Business Guidance Centers to support the maintenance and enhancement of the sanitation levels of environmental health-related businesses, which are closely involved in the daily lives of the public and are subject to strong demands to maintain sanitation levels, through Environmental Health Business Loans. The majority of the borrowers of Environmental Health Business Loans are businesses with nine or fewer employees. Approximately 80% are sole proprietorship, and approximately 60% have been before start-ups or within five years of start-ups.

Educational Loans for School Entrance Fees and Related Expenses

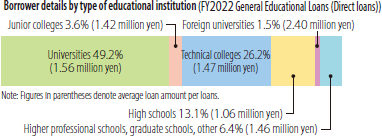

The Micro Unit handles Educational Loans, which funds necessary expenses when entering educational institutions or continuing one's education, to lighten the financial burden of educational expenses on families and provide equal educational opportunities. Approximately 90,000 Educational Loans were provided in FY2022.

Loans to families with large educational expenses

Educational Loans are primarily provided to families with university or technical college students, who incur large educational expenses.

Providing Loans Secured by Governmental Pensions or Mutual Pensions

Loans Secured by Governmental Pensions or Mutual Pensions, etc., are offered only by JFC (or the Okinawa Development Finance Corporation in Okinawa Prefecture) in accordance with the Act on Loans Rendered by Japan Finance Corporation Secured by Public Officers Pension (Act No. 91 of 1954). These loans can be used for a broad range of purposes, including home purchases and business funding. New applications were closed at the end of March 2022 due to the amendment of pension system laws in 2020, with the exception of military pensions and relief pensions.