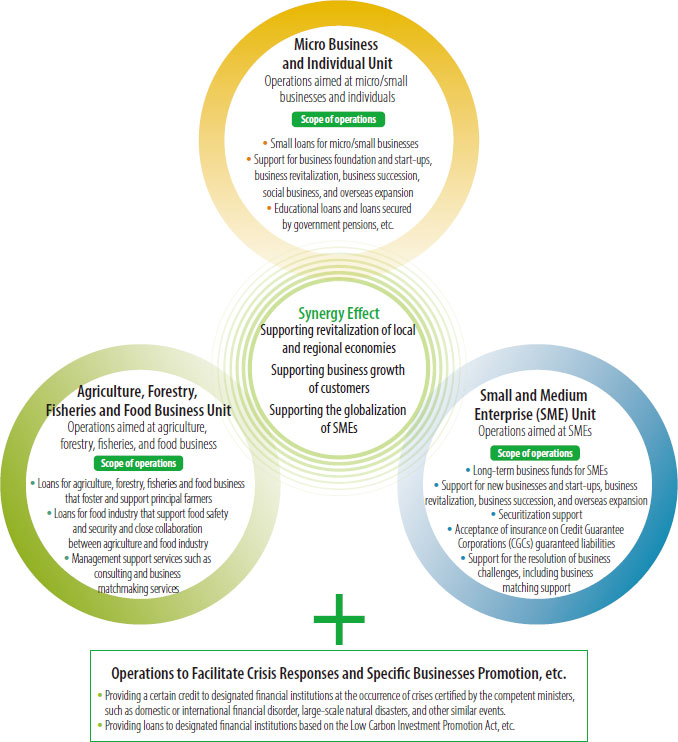

Overview of Operations

JFC is a policy-based financial institution that aims to complement financial activities carried out by private financial institutions and contributes to the improvement in the living standards of Japanese people.

Major Business Operations of JFC

Micro Business and Individual Unit

The Micro Business and Individual Unit (Micro Unit) acts as a community-based financial institution. It provides business loans to micro/small businesses and business start-ups, and educational loans to individuals who are in need of funds for school entrance fees and other educational expenses.

Characteristics of Business Loans

- Supporting Micro/Small Businesses

- Demonstrating Safety Net Functions

- Supporting Customers' Business Continuity and Growth

- Supporting Business Start-ups (consisting of those that have yet to start and those that are within 1 year of start-up) Proactively

- Establishment of Business Start-up Support Centers and Business Support Plazas and Providing Support for Business Start-ups

- Supporting Start-ups

- Supporting Business Revitalization Actively

- Supporting Business Succession Actively

- Supporting Social Business Actively

- Supporting Businesses Seeking for Overseas Expansion Actively

- Collaboration with Regional Financial Institutions, Chambers of Commerce and Industry, Societies of Commerce and Industry, and Environmental Health Trade Associations

- Educational Loans for School Entrance Fees and Related Expenses

- Providing Loans Secured by Governmental Pensions or Mutual Pensions

Operational Performances

International Cooperation

Publications

Agriculture, Forestry, Fisheries and Food Business Unit

The Agriculture, Forestry, Fisheries and Food Business Unit (AFFF Unit) contributes to the reinforcement of the domestic agriculture, forestry, and fisheries industries and stable supplies of safe and high-quality foods by supporting individuals and businesses in these industries through finance or other services.

Characteristics of Business Loans

- Agriculture

- Forestry

- Fisheries

- Food Processing and Distribution Industry

- Demonstrating Safety Net Functions Following Disasters and Changes in Business Conditions

- Supporting Initiatives to Export

- Supporting New Entrants into Agriculture and New Farmers

- Promotion of Consulting and Financing Activities

- Support for Private Financial Institutions in the Agricultural, Forestry, and Fisheries Sectors

Operational Performances

Loans

International Cooperation

Small and Medium Enterprise Unit

Through its various functions such as Loan Programs and Credit Insurance Programs, the Small and Medium Enterprise Unit (SME Unit) financially supports the growth and development of SME's and micro/small businesses which are the source of Japan's economic vitality as well as the primary force underpinning regional economies.