Business and Management Plan

JFC has formulated the following Business and Management Plan for the period from FY2023 on.

Business and Management Plan(FY2023-2025)

Connect Policy with Businesses and Communities and Support Them

Amidst the lingering effects of the COVID-19 pandemic combined rising prices caused by soaring global energy prices and other factors in Japan, the SMEs, micro/small businesses, and agricultural, forestry and fisheries businesses that support Japan's economy and local communities are facing a challenging business environment.

Under the circumstances, the continuation of business and steady efforts to achieve growth and development by the business operators who will support Japan in the future is a pressing issue.

In light of this, JFC will undertake the following actions with a sense of mission to connect policy with businesses and local communities and support them.

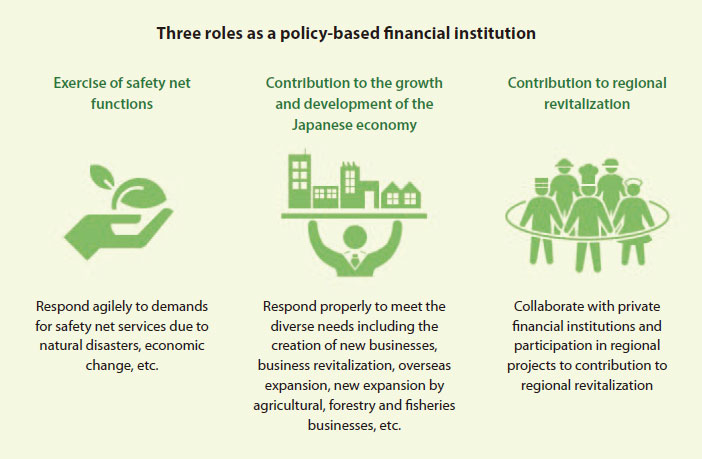

First, based on a strong awareness of the roles of policy-based finance, we will create frameworks capable of responding to all crises and perform safety net functions for SMEs, micro/small businesses, and agricultural, forestry and fisheries businesses under all circumstances.

Next, we will perform our risk-taking functions and provide powerful support in growth fields including the start-ups that will support growth by Japan's economy, promotion of exports, and business succession that links with future generations.

We will also leverage our nationwide network of 152 branches to support SMEs, micro/small businesses, and agricultural, forestry and fisheries businesses that support local communities to achieve regional revitalization.

Furthermore, we will reinforce policy-based functions by deepening collaboration with private financial institutions and relevant organizations, enhancing customer service through performance of consulting functions, promoting digitalization and DX to achieve operational efficiency, enhancing the capabilities of the personnel who perform these functions, and creating workplaces where diverse human resources can play active roles.

In carrying out our affairs, we will follow the principle of "doing ordinary tasks with excellence" while maintaining a high level of awareness of compliance and steadily and appropriately building on each individual task. In addition, taking a bottom-up approach to management as our motto, we aim to gain an accurate understanding of customer and regional needs, respond empathetically, and become a more familiar and reliable presence.

Business Operation Plans

1.Perform safety net functions, provide a stable supply of funds, and collaborate with private financial institutions

- Support clients affected by the COVID-19 Crisis.

- Perform safety net functions for customers.

- Provide funds to customers in a timely and efficient manner.

- Steadily implement the credit supplementation system.

- Reinforce collaboration with private financial institutions.

2.Provide priority support to growth fields, etc.

- Business foundation, start-ups, and new businesses.

- Business revitalization.

- Business succession.

- Social business.

- Overseas expansion.

- New expansion by agricultural, forestry and fisheries businesses.

- DX and digitalization, etc.

- Environmental and energy measures.

- Equal educational opportunities.

- Development, provision, and introduction of advanced information and communications systems.

- Secure stable supplies of specified key goods, etc.

3.Contribution to local and regional revitalization

- Reinforce collaboration with local government.

- Provision of useful service that meets customer and local needs.

- Performance of the role of connecting relevant organizations.

4.Improve customer service and demonstrate policy significance

- Promote various measures such as enhancing the consultation capability to improve services and appropriately perform a risk-taking function.

- Promote public relations activities.

- Enhance surveys and research and further demonstrate think tank functions.

- Improve systems and measures through policy recommendations that conform to customer feedback and the needs on-site.

5.Appropriate management of credit risk

- Appropriately manage credit risks taking into consideration the effects of the COVID-19 pandemic, rising prices, and other factors on businesses.

Organizational Plans

1.Promote digitalization and DX

- Steadily promote digitalization and DX in accordance with a digitalization promotion plan and other plans.

- Reinforce preparations relating to information systems in anticipation of emergencies.

- Enhance stable system operations and implement comprehensive security measures.

- Reinforce internal stance to promote digitalization.

- Appropriate enforcement of system audits.

2.Enhancing branch office functions

- The branch office manager will faithfully exhibit its role.

- Strengthen our nationwide network of 152 branches.

- Continuously strengthen the branch management framework based on a bottom-up approach to management including implementation of measures intended to solve branch operational issues in light of changes in the business environment.

3.Conduct efficient and effective operations

- Review administrative work and take other measures to enable timely and detailed responses to the rapid increase in applications.

- Broadly collect opinions and requests from worksites and implement measures to use them in operational improvements.

- Implement fair procurement procedures.

- Improve branches and other facilities based on the needs of customers and branches.

- Implement environmentally-conscious measures including encouraging the use of products and services that contribute to reduced environmental impact.

- Implementation of appropriate expense management.

4.Foster and utilize human resources

- Enhance staff training for the realization of high-quality customer service and to nurture high-level management capabilities and expertise.

- Appropriately operate personnel payroll system.

- Promote effective utilization of human resources.

- Increase expertise.

5.Promote diversity and improve the workplace environment

- Create a workplace where diverse human resources can fulfill their potential.

- Promote women's empowerment including actively appointing women to management positions.

- Strengthen harassment prevention.

6.Establishment and strengthening of risk management, compliance structures, and risk management framework

- Carry out appropriate risk management in response to policy requests.

- Carry out appropriate monitoring together with establishing and strengthening compliance awareness.

- Further strengthen risk management framework.