OperationsSmall and Medium Enterprise Unit

Operational Performances

Loan Programs

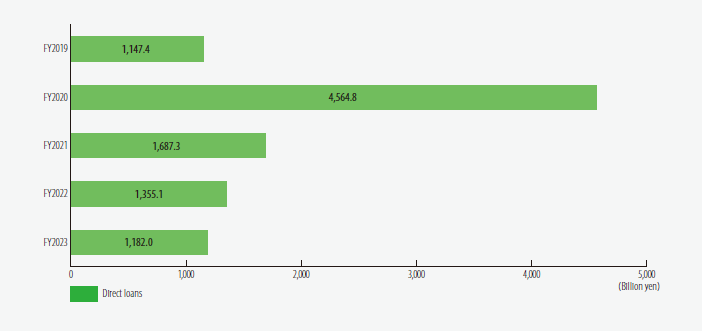

Changes in Annual Loan Operations

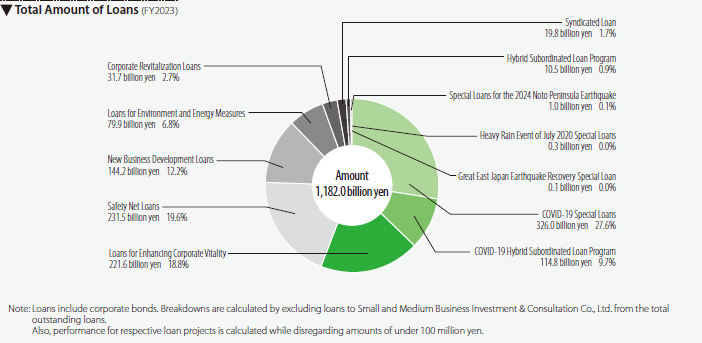

Breakdown of Loans by Scheme

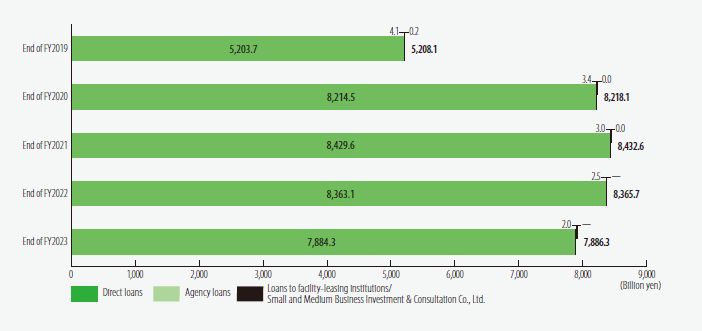

Changes in Outstanding Loans

Breakdown of Outstanding Loans by Industry

(Billion yen,%)

| End of FY2019 |

End of FY2020 |

End of FY2021 |

End of FY2022 |

End of FY2023 |

|

|---|---|---|---|---|---|

| Manufacturing | 2,387.4 (45.8) |

3,220.1 (39.2) |

3,231.1 (38.3) |

3,222.2 (38.5) |

3,049.3 (38.7) |

| Construction | 249.4 (4.8) |

516.4 (6.3) |

534.4 (6.3) |

527.1 (6.3) |

488.3 (6.2) |

| Wholesale & retail | 787.1 (15.1) |

1,413.7 (17.2) |

1,450.1 (17.2) |

1,436.4 (17.2) |

1,324.4 (16.8) |

| Transportation & telecommunications | 549.9 (10.6) |

850.6 (10.4) |

888.7 (10.5) |

903.1 (10.8) |

884.6 (11.2) |

| Services | 612.5 (11.8) |

1,488.9 (18.1) |

1,608.2 (19.1) |

1,585.4 (19.0) |

1,496.1 (19.0) |

| Others | 621.1 (11.9) |

728.1 (8.9) |

719.8 (8.5) |

691.2 (8.3) |

643.4 (8.2) |

| Total | 5,207.9 (100.0) |

8,218.0 (100.0) |

8,432.6 (100.0) |

8,365.7 (100.0) |

7,886.3 (100.0) |

- Notes:

-

- Loans include corporate bonds. Outstanding balances are calculated by deducting the amounts of loans to facility-leasing institutions/Small and Medium Business Investment & Consultation Co., Ltd. from the total balance.

- Figures in parentheses denote percentage of shares.

Breakdown of Outstanding Loans by Use

(Billion yen,%)

| End of FY2019 |

End of FY2020 |

End of FY2021 |

End of FY2022 |

End of FY2023 |

|

|---|---|---|---|---|---|

| Operating funds | 2,785.2 (53.5) |

5,919.4 (72.0) |

6,184.6 (73.3) |

6,090.7 (72.8) |

5,566.1 (70.6) |

| Facility funds | 2,422.6 (46.5) |

2,298.5 (28.0) |

2,247.9 (26.7) |

2,274.9 (27.2) |

2,320.2 (29.4) |

| Total | 5,207.9 (100.0) |

8,218.0 (100.0) |

8,432.6 (100.0) |

8,365.7 (100.0) |

7,886.3 (100.0) |

- Notes:

-

- Loans include corporate bonds. Outstanding balances are calculated by deducting the amounts of loans to facility-leasing institutions/Small and Medium Business Investment & Consultation Co., Ltd. from the total balance.

- Figures in parentheses denote percentage of shares.

Number of Borrowers

(Number of borrowers)

| End of FY2019 |

End of FY2020 |

End of FY2021 |

End of FY2022 |

End of FY2023 |

|

|---|---|---|---|---|---|

| Number of borrowers | 44,102 | 61,074 | 62,010 | 62,004 | 58,249 |

- Note:

- Figures cover only businesses with direct loans.

Average Loan Balance per Business

(Million yen)

| End of FY2019 |

End of FY2020 |

End of FY2021 |

End of FY2022 |

End of FY2023 |

|

|---|---|---|---|---|---|

| Average loan balance per business | 117 | 134 | 135 | 134 | 135 |

- Note:

- Figures cover only businesses with direct loans.

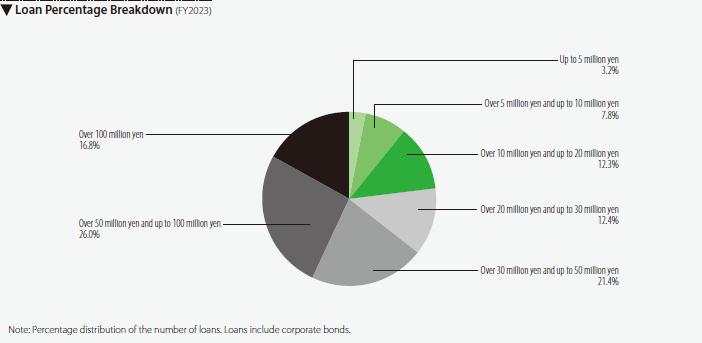

Loans by Credit Amount

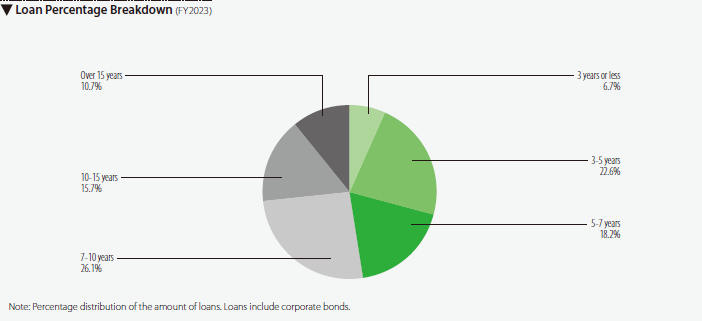

Loans by Repayment Period

Credit Insurance Programs

(Billion yen)

| Items | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 |

|---|---|---|---|---|---|

| Amounts of insurance acceptance and loans | |||||

|

Small Business Credit Insurance |

8,324.3 | 33,210.6 | 8,768.4 | 7,762.0 | 9,555.1 |

|

Loans to CGCs |

- | - | - | - | - |

|

Special Insurance for Mid-size Enterprises |

- | - | - | - | - |

| Outstanding amounts of insurance and loans | |||||

|

Small Business Credit Insurance |

21,244.8 | 42,416.1 | 42,092.3 | 40,671.3 | 36,627.6 |

|

Loans to CGCs |

- | - | - | - | - |

|

Special Insurance for Mid-size Enterprises |

0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

|

Machinery Credit Insurance |

- | - | - | - | - |

- Notes:

-

- Suspending the acceptance of new insurance since FY2003, the SME Unit currently pays on insurance money and receives recoveries based on insurance contracts already in force (Transitional Operation of the Machinery Credit Insurance Programs).

- Outstanding amounts of insurance and loans are as of March 31, 2024.

Securitization Support Programs

(Billion yen)

| Items | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 |

|---|---|---|---|---|---|

| Financing support amount | |||||

| Purchase-type | 33.2 | 17.0 | 34.3 | 41.0 | 45.4 |

| Guarantee-type | - | - | - | - | - |

| Outstanding amount of financing support | |||||

| Purchase-type | 78.3 | 65.9 | 71.6 | 84.8 | 102.9 |

| Guarantee-type | - | - | - | - | - |

| Outstanding amounts of trust beneficiary rights and guaranteed liabilities | |||||

| Purchase-type (outstanding amount of trust beneficiary rights) |

17.4 | 12.9 | 15.4 | 23.1 | 20.2 |

| Purchase-type (outstanding amounts of asset-backed securities) |

14.9 | 17.8 | 21.6 | 23.2 | 22.5 |

| Guarantee-type (outstanding amount of guaranteed liabilities) |

0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Standby Letter of Credit Program (outstanding amount of guaranteed liabilities) |

4.7 | 5.0 | 4.9 | 4.9 | 5.4 |

- Notes:

-

- Purchase-type refers to operations prescribed in Article 11-1-2 of the Japan Finance Corporation Act as well as Items 3, 5, 7 and 8 on the Schedule II thereof.

- Guarantee-type refers to operations prescribed in Article 11-1-2 of the Japan Finance Corporation Act as well as Items 4 and 6 on the Schedule II thereof.

- Outstanding amounts of asset-backed securities refer to subordinated amounts acquired by JFC out of asset-backed securities and trust beneficiary rights and regarding the purchase-type securitization support programs.

- Standby Letter of Credit Program refers to the operations of debt guarantee which are deemed to be operations prescribed in Article 11-1-2 of the Japan Finance Corporation Act as well as Item 4 on the Schedule II thereof by SMEs Business Enhancement Act, etc., Support under the SME Regional Resources Utilization Promotion Law, the Law to Promote Collaboration between Agriculture, Commerce and Industry, the Act on Support for Strengthening Agricultural Competitiveness, and the Act on Rationalization of Foodstuff Distribution and Normalization of Foodstuff Trading.(Note)

- Outstanding amounts of trust beneficiary rights and guaranteed liabilities are as of March 31, 2024.

- Note:

- This is a literal translation, not an official English name.