Operations

Agriculture, Forestry, Fisheries and Food Business Unit

(Overview of Operations)

Overview of Operations

The Agriculture, Forestry, Fisheries and Food Business Unit (AFFF Unit) contributes to the reinforcement of the domestic agriculture, forestry, and fisheries industries and stable supplies of safe and high-quality foods by supporting individuals and businesses in these industries through finance or other services.

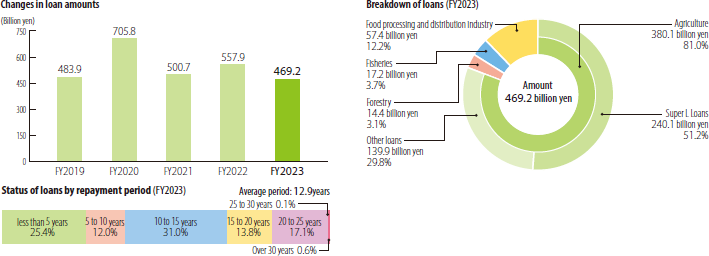

Loan Status and Operation Features

The AFFF Unit provides long-term loans that contribute to ensuring stable food supplies or sustainable and sound development of the agriculture, forestry and fisheries sectors, based on the unique business characteristics of the industry such as long investment payback period and instability of income caused by external factors like weather.

Demonstration of Safety Net Functions

The AFFF Unit offers dynamic support in the form of long-term working capital loans to demonstrate safety net function against the financial effects on agriculture, forestry, and fisheries businesses due to temporary crises such as natural disasters including earthquakes, typhoons, and tsunamis, etc., contagious livestock diseases, soaring oil prices, and price hikes.

Support for Sustainable Business Development

In response to the increasingly sophisticated and diverse management issues that customers are facing as a result of natural disasters and changes in social and economic conditions in Japan and overseas, the AFFF Unit promotes “consulting and financing activities” to help customers analyze their current situation and solve their problems with accompanied supports.

Support offered to customer in different management stages

Through intensive and ongoing consulting and financing activities, the AFFF Unit helps customers resolve issues according to their different management stages, such as start-ups at the time of establishment, expansion (growth) in the growth phase, and further development in the maturity phase.

Identification of current status and issues through financial analysis

We analyze financial situations based on the financial information provided by customers and compare them to the AFFF Unit management indicators for other companies in the same industry. Through this process, we visualize customer strengths and management issues and share this information with the customer.

Promotion of Cooperation with Private Financial Institutions in the Agriculture, Forestry, and Fisheries Sectors

The AFFF Unit promotes collaborative financing with private financial institutions such as cooperative loans and outsourced lending and is working to build an environment that encourages private financial institutions to actively enter financing of agricultural, forestry and fisheries fields by providing information service on industry trends and assessment of agricultural credit risks (Agricultural Credit Risk Information Service (ACRIS)) and also offering capital contributions and securitization support services.