OperationsAgriculture, Forestry, Fisheries and Food Business Unit

Support for Private Financial Institutions in the Agriculture, Forestry, and Fisheries Sectors

The AFFF Unit works to create an environment that encourages private financial institutions to actively provide loans to agricultural, forestry, and fisheries businesses by providing information concerning risk assessments as well as by supporting financing and securitization.

Working to Strengthen Cooperation with Private Financial Institutions

The AFFF Unit provides loans to agriculture, forestry, and fisheries business operators and companies in the processed food industry in cooperation with private financial institutions. In FY2023, a total of 1,011 cooperative loans were provided in cooperation with private financial institutions (Note).

The AFFF Unit also provides JFC loans through 619 private financial institutions with which it has entered into outsourcing agreements. The number of JFC loans provided through private financial institutions was 9,549, and this was 58.8% of total loans.

Note:Loans (guarantees) that are disbursed or decided by both JFC and private financial institutions after consultation by both parties for loan plans with identical objectives (Calculated by JFC. Including loans made on different dates between both parties).

Agricultural Credit Risk Information Service (ACRIS)

The Agricultural Credit Risk Information Service (ACRIS) is an agricultural scoring model designed by the AFFF Unit to facilitate the active entry by private financial institutions into the market of agricultural finance (a fee-based membership service).

The AFFF Unit positions ACRIS as a tool for stimulating agricultural lending to strengthen its business collaboration with ACRIS members such as financial institutions and tax accountants.

The accuracy of the model is examined annually, and improvements are made to reflect economic conditions and other factors if necessary.

Securitization Support

The AFFF Unit established a credit supplementation program (securitization support operation) using credit default swap (CDS) to encourage private financial institutions to promote agricultural lending. This program has been in operation since October 2008. By using this program, private financial institutions can transfer credit risks worth up to 80% of the loan amounts or a maximum of 50 million yen to JFC.

As of March 31, 2024, a total of 138 financial institutions had signed a basic agreement with the AFFF Unit.

95 of these financial institutions developed new loan products for farmers that incorporated credit supplementation under this program.

| Banks | Shinkin banks |

Credit cooperatives |

Total | |

|---|---|---|---|---|

| Hokkaido | 1 | 13 | 2 | 16 |

| Tohoku | 7 | 5 | 1 | 13 |

| Kanto | 3 | 9 | 2 | 14 |

| Chubu | 7 | 24 | 4 | 35 |

| Kinki | 4 | 11 | - | 15 |

| Chugoku | 2 | 11 | 1 | 14 |

| Shikoku | 5 | 2 | - | 7 |

| Kyushu | 10 | 13 | 1 | 24 |

| Total | 39 | 88 | 11 | 138 |

| (Of these, institutions that developed new programs) | (31) | (57) | (7) | (95) |

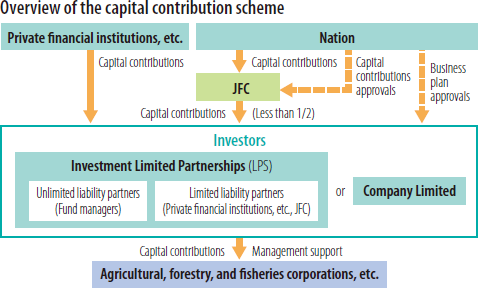

Providing Investment Support to Agriculture, Forestry and Fisheries Corporations, etc.

The AFFF Unit has been making capital contributions to Investment Limited Partnerships (LPs) and stock companies to invest in agricultural, forestry, and fisheries corporations with business program approval from the Minister of Agriculture, Forestry and Fisheries. This is done to support the adequacy of equity capital of leading agricultural, forestry, and fisheries corporations and food processing businesses and provide capital to businesses involved in all stages of the food value chain.

| LPS | Company Limited | |

|---|---|---|

| Number of capital contributions | 20 associations | 1 company |

| Pledged investment amount or investment amount (of which invested by JFC) |

17.7 billion yen (6.2 billion yen) |

6.0 billion yen (2.5 billion yen) |