Feature of Operations

Agriculture

By providing loans in line with the policies of "Basic Law on Food, Agriculture and Rural Areas," and "Basic Plan for Food, Agriculture and Rural Areas," the AFFF Unit actively supports efforts of farmers to improve their management with drive and innovative ideas.

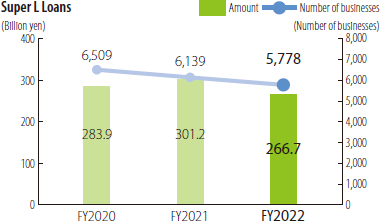

Supporting leading farmers through long-term loans

Through long-term loans such as Super L Loans the AFFF Unit supports management improvements such as scale expansion, cost reduction and the "Sixth industrialization" (e.g., processing, sales, and other business undertaken integrally by agriculture, forestry, and fishery businesses to increase the added value of products) by diverse local farmers, which include companies of rice growing, horticulture, livestock farming, and other businesses, as well as large-scale family run operations, new farmers, and companies entering the agriculture field.

Forestry

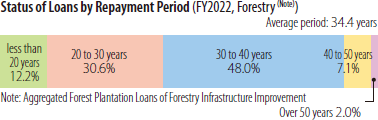

By providing loans in line with the policies of "Forest and Forestry Basic Act," the AFFF Unit actively supports the improvement of forest that has multifunctional roles, and the creation of structures to supply and process domestically harvested lumber.

The AFFF Unit provides loan programs to customers in the forestry business, for which capital recovery period is very long

It generally takes about 50 years for a forest to develop and so recovering any capital takes a very long time. For this reason, the AFFF Unit supports forestry operators by providing the ultra-long-term finance that is required until deforestation.

Fisheries

By supplying loans in line with the policies of "Fisheries Basic Act," the AFFF Unit actively supports efforts to ensure a stable supply of marine products and the sustained use of marine resources.

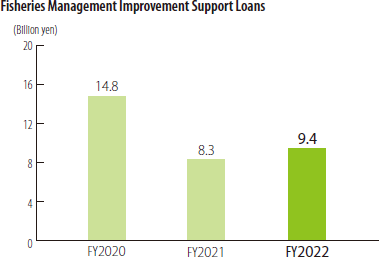

Supporting leaders in fisheries industry

The Fisheries Management Improvement Support Loan is a financing program that provides comprehensive support to leaders in fisheries industry wishing to improve their businesses.

In FY2022, Fisheries Management Improvement Support Loans came to 9.4 billion yen.

Food Processing and Distribution Industry

Through providing loans to food processing and distribution industry that deal in domestic agriculture, forestry, and fishery products, the AFFF Unit actively supports efforts for the stable supply of food and the sound development of the domestic agriculture, forestry and fisheries businesses.

Helping to promote the use of domestic agricultural, forestry, and fishery products

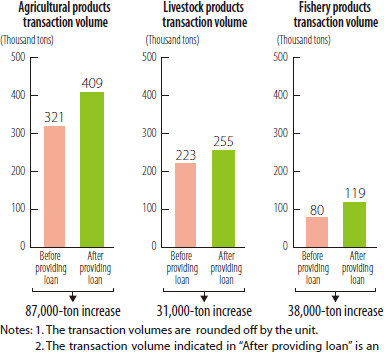

Loans to the food processing and distribution industry to use domestic agriculture, forestry, and fishery products as raw materials or as products, and are aimed at promotion of domestically produced agriculture, forestry, and fishery products. An estimation of the effects of the loans made in FY2022 suggests that the transaction volumes of domestically produced agriculture, forestry, and fishery products will increase by approximately 157,000 tons over the next five years.

In particular, Hilly and Mountainous Areas Revitalization Loan and the Food Distribution System Improvement Loan (Food production manufacturing affiliated business facilities, food production and sales affiliated business facilities) require borrowers to increase the trading volume of domestically produced agriculture, forestry and fishery products. The requirement helps promote collaboration between the agriculture, forestry and fisheries sectors and the food industry.

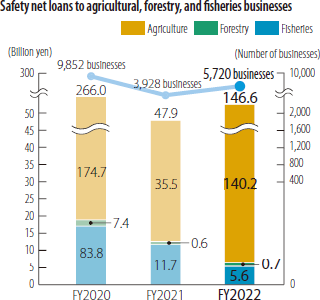

Demonstrating Safety Net Functions Following Disasters and Changes in Business Conditions

The AFFF Unit offers dynamic support in the form of long-term working capital loans to demonstrate safety net function against the financial effects on agriculture, forestry, and fisheries businesses due to temporary crises such as natural disasters including earthquakes, typhoons, and tsunamis,

etc., contagious livestock diseases, soaring oil prices and price hikes, as well as COVID-19.

Also, the AFFF Unit establishes special consultation desks and is providing consultations on loan and repayment for agriculture, forestry, and fisheries operators that have been affected by soaring oil prices and price hikes, etc.

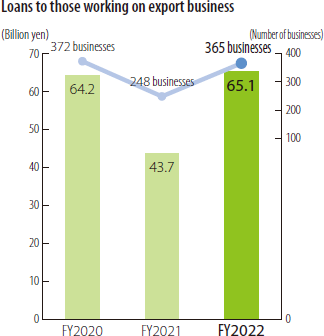

Supporting Initiatives to Export

In addition to the Agriculture, Forestry, and Fisheries Products and Food Export Framework Reinforcement Loan established in FY2022, the AFFF Unit provides support through various loan programs and the provision of information in cases where agriculture, forestry, and fisheries business operators and companies in the food industry export domestic agriculture, forestry and fisheries products and foods to improve their own business or promote domestic agriculture, forestry, and fisheries products.

In FY2022, loan performances to those who work on management improvement through exports came to: 365 businesses (147% compared to the previous fiscal year) ,65.1 billion yen (149% compared to the previous fiscal year).

Supporting New Entrants into Agriculture and New Farmers

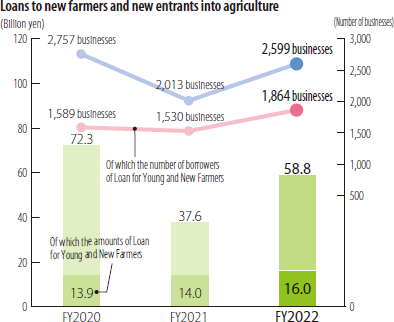

By providing various loan programs such as Loan for Young and New Farmers which offers loans to new farmers, new entrants into agricultural business, and authorized new farmers and information was provided.

Loans to new farmers and new entrants into agriculture

In FY2022, performance of loan to new entrants into agricultural business and new entry farmers came to 2,599 businesses (129% compared to the previous fiscal year), and 58.8 billion yen (156% compared to the previous fiscal year).

Performance of Loan for Young and New Farmers (Note) which was launched in FY2014 came to: 1,864 businesses (122% compared to the previous fiscal year), 16.0 billion yen (114% compared to the previous fiscal year).

Note: Loans to support new farmers who are about to start their businesses and are certified by municipalities under the Young and New Farmers Plan.